by Tom Stilp JD, MBA/MM, LLM, MSC, DBA, September 29, 2025

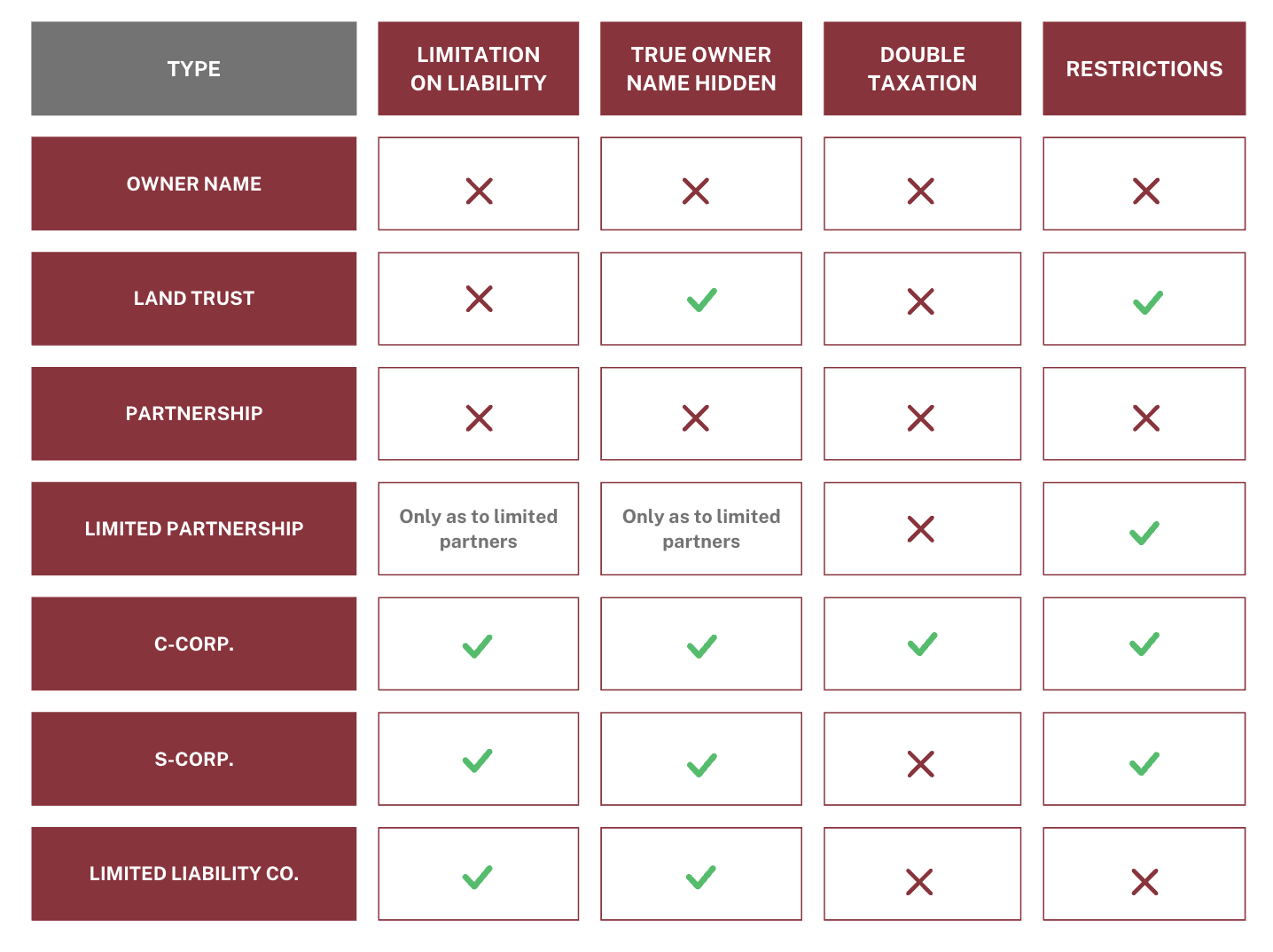

Following fast on the heels of a decision to go into a particular kind of business is the decision about what kind of legal form it should take. The most common options are a sole proprietorship, a partnership, or a corporation. You may lean toward the corporate route because you like the sound of having “Inc.” or “LLC” after the company’s name, but there are some more practical, business-like considerations to take into account. Below is a summary of corporate forms (Stilp, 2020, p. 128)

Incorporating a business is the next logical step many entrepreneurs and consultants face to grow their business. Incorporating a business offers a number of advantages, including limited liability for business debts and obligations. But there are other advantages too. Incorporation provides an established set of rules around which to organize a business for future growth, and ensures predictability on how the business will be structured. In addition, incorporation tells third-parties, such as vendors, customers, and banks with whom your business deals that you have taken the extra step of incorporating to create a more professional image.

More so than with some of the other structures for a business, starting a corporation means complying with formalities required by state law. Once the members or shareholders (owners) of the business agree on some basic matters, such items are embodied in the articles of incorporation filed with the appropriate state agency. These essentials usually include: (i) corporate name; (ii) the number of shares that can be issued, or percentage ownership of members; (iii) what contribution of cash or property or services is required; (iv) the nature of the corporation’s business; (v) the identity of the officers or managers of the corporation who will handle day-today operations. The fledgling corporation will also need bylaws, or an operating agreement, which constitutes a procedural rule book for the company.

Thus, despite the “Legal Zoom” ads which lead to a level of superficiality that few with any knowledge of the subject would endure, there are significant, and long-lasting questions. The bottom line here is that whoever holds a majority of the shares or percentage interest of a corporation has ultimate control over it. Usually it takes a majority to make the “big picture” decisions. If a decision is momentous enough for the company’s future, such as a change in the articles of incorporation or whether or not to sell all or substantially all of the company’s assets, the owners (members or shareholders) usually have a more direct role in that they themselves must approve the decision by a certain margin of votes (e.g., a simple majority of 51%, a super majority such as 75% or unanimity).

Having incorporated thousands of new businesses, as experienced Counsel, we can help.

References

Stilp, T. (2020). Making money going into the deal: The art & science of real estate. (Rev. 2nd ed).